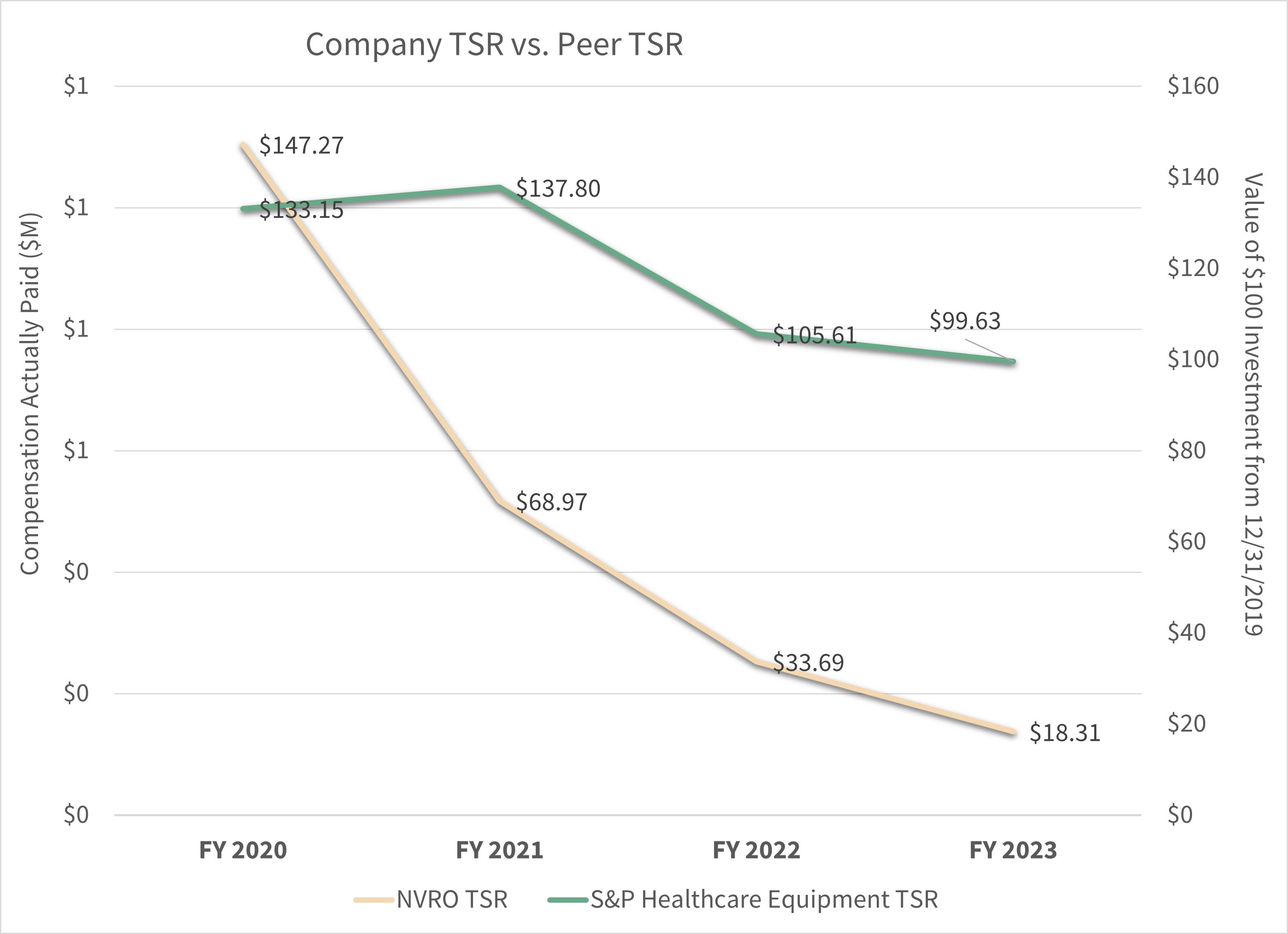

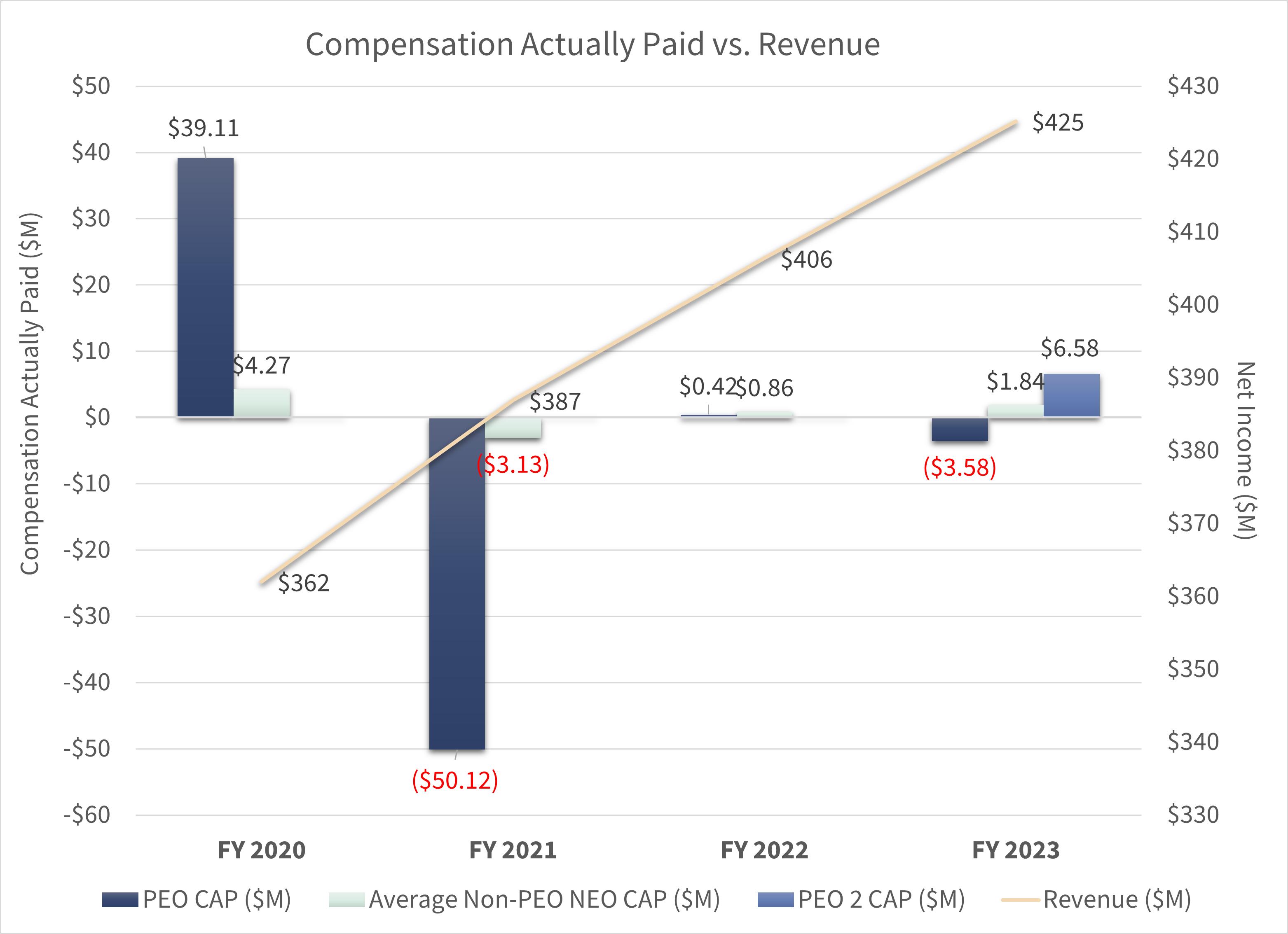

The charts below show, for the past four years, the relationship of our TSR relative to the S&P Healthcare Equipment Select Industry Index.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrant x☒

Filed by a Party other than the Registrant ¨☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒Definitive Proxy Statement

☐Definitive Additional Materials

☐Soliciting Material under §240.14a-12

NEVRO CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box)all boxes that apply):

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

| ||||

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

NEVRO CORP.

1800 Bridge Parkway

Redwood City, California 94065

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON MAY 18, 2016May 23, 2024

To the Stockholders of Nevro Corp.:

NOTICE IS HEREBY GIVEN that the Annual Meeting of Stockholders (the “Annual Meeting”) of Nevro Corp., a Delaware corporation (the “Company”), will be held on May 18, 201623, 2024 at 10:30 a.m. local time, atPacific Time. This year’s Annual Meeting will be held entirely online to allow greater participation and improved communication and provide cost savings for our stockholders and the Sofitel San Francisco Bay, 223 Twin Dolphin Drive, Redwood City, CA 94065Company. You will be able to attend and participate in the Annual Meeting online by visiting www.virtualshareholdermeeting.com/NVRO2024, where you will be able to listen to the meeting live, submit questions and vote. The Annual Meeting will be held for the following purposes:

The foregoing items of business are more fully described in the Proxy Statement accompanying this Notice of Annual Meeting of Stockholders. Only stockholders who owned common stock of the Company at the close of business on March 23, 201628, 2024 (the “Record Date”) can vote at this meeting or any adjournments that take place.

The Board of Directors recommends that you vote as follows on the matters to be presented to stockholders at the Annual Meeting:

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING IN PERSON,ONLINE, WE ENCOURAGE YOU TO READ THE ACCOMPANYING PROXY STATEMENT AND OUR 20152023 ANNUAL REPORT ON FORM 10-K AND SUBMIT YOUR PROXY AS SOON AS POSSIBLE USING ONE OF THE THREE CONVENIENT VOTING METHODS DESCRIBED IN THE SECTION TITLED “INFORMATION ABOUT THE PROXY PROCESS AND VOTING” IN THE PROXY STATEMENT. IF YOU RECEIVE MORE THAN ONE SET OF PROXY MATERIALS OR NOTICE OF INTERNET AVAILABILITY BECAUSE YOUR SHARES ARE REGISTERED IN DIFFERENT NAMES OR ADDRESSES, EACH PROXY SHOULD BE SIGNED AND SUBMITTED TO ENSURE THAT ALL OF YOUR SHARES WILL BE VOTED.

By Order of the Board of Directors | ||

/S/ | ||

Kevin Thornal | ||

President and Chief Executive Officer | ||

Redwood City, California | ||

April 12, 2024 |

Redwood City, California

April 6, 2016

NEVRO CORP.

1800 Bridge Parkway

Redwood City, California 94065

PROXY STATEMENT

FOR THE 20162024 ANNUAL MEETING OF STOCKHOLDERS

MAY 18, 2016May 23, 2024

We have sent you this Proxy Statement and the enclosed Proxy Card because the Board of Directors (the “Board”) of Nevro Corp. (referred to herein as the “Company,” “Nevro,” “we,” “us” or “our”) is soliciting your proxy to vote at our 20162024 Annual Meeting of Stockholders (the “Annual Meeting”) to be held on Wednesday,Thursday, May 18, 201623, 2024 at 10:30 a.m. local time, atPacific Time. The Annual Meeting can be accessed by visiting www.virtualshareholdermeeting.com/NVRO2024, where you will be able to listen to the Sofitel San Francisco Bay, 223 Twin Dolphin Drive, Redwood City, CA 94065.meeting live, submit questions and vote online.

In addition to solicitations by mail, our directors, officers and regular employees, without additional remuneration, may solicit proxies by telephone, e-mail and personal interviews. We may retain outside consultants to solicit proxies on our behalf as well. All costs of solicitation of proxies will be borne by us. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of stock held in their names, and we will reimburse them for their reasonable out-of-pocket expenses incurred in connection with the distribution of proxy materials.

Pursuant to the rules adopted by the Securities and Exchange Commission (the “SEC”), we have elected to provide access to our 2016 Annual Meeting materials, which include this Proxy Statement and our Annual Report on Form 10-K for the year ended December 31, 20152023 (the “Form 10-K”), over the internet in lieu of mailing printed copies. We will begin mailing the Notice of Internet Availability to our stockholders of record as of March 23, 201628, 2024 (the “Record Date”) for the first time on or about April 6, 2016.12, 2024. The Notice of Internet Availability will contain instructions on how to access and review the 2016 Annual Meeting materials and will also contain instructions on how to request a printed copy of the Annual Meeting materials. In addition, we have provided brokers, dealers, banks, voting trustees and their nominees, at our expense, with additional copies of our proxy materials and the Form 10-K so that our record holders can supply these materials to the beneficial owners of shares of our common stock as of the Record Date. The Form 10-K is also available in the “Financial Information” section of our website at http://www.nevro.com/.

The only outstanding voting securities of Nevro are shares of common stock, $0.001 par value per share (the “common stock”), of which there were 28,298,82336,681,392 shares outstanding as of the Record Date (excluding any treasury shares). The holders of a majority in voting power of the shares of common stock issued and outstanding and entitled to vote, present in personattendance online or represented by proxy, are required to hold the Annual Meeting.

1

Pursuant to the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), we are not required to seek an advisory non-binding “Say-on-Pay” vote on executive compensation from our stockholders until the end of the three-year period beginning on the date of first sale of our common stock pursuant to an effective registration statement under the Securities Act of 1933, as amended, which occurred in November 2014 in connection with our initial public offering (“IPO”). Therefore, we are not currently seeking an advisory “Say-on-Pay” vote; however, we are seeking a non-binding advisory vote of our stockholders on the frequency of future advisory votes by stockholders on executive compensation (Proposal 3). In compliance with the phase-in period provided in the JOBS Act, we intend to seek an advisory “Say-on-Pay” vote beginning with the annual meeting of stockholders to be held in 2017.

INFORMATION ABOUT THE PROXY PROCESS AND VOTING

Why am I receiving these materials?

We have made this Proxy Statement and Proxy Card available to you on the internet or, upon your request, have delivered printed proxy materials to you, because the Board is soliciting your proxy to vote at the Annual Meeting, including any adjournments or postponements of the Annual Meeting.thereof. You are invited to attend the Annual Meeting to vote on the proposals described in this Proxy Statement. However,online; however, you doare not needrequired to attend the Annual Meeting in order to vote your shares. Instead, you may simply complete, sign and return the Proxy Card, or follow the instructions below to submit your proxy over the telephone or on the internet.

This Proxy Statement, the Notice of Internet Availability, the Notice of Annual Meeting and accompanying Proxy Card were first made available for access by our stockholders on or about April 6, 201612, 2024 to all stockholders of record entitled to vote at the Annual Meeting.

Who can vote at the Annual Meeting?

Only stockholders of record at the close of business on the Record Date will be entitled to vote at the Annual Meeting. At the close of business on the Record Date, there were 28,298,82336,681,392 shares of common stock issued and outstanding and entitled to vote. A list of the names of stockholders entitled to vote at the Annual Meeting will be available to stockholders for ten days prior to the Annual Meeting for any purpose germane to the Annual Meeting. Please contact our Corporate Secretary, c/o Nevro Corp., 1800 Bridge Parkway, Redwood City, California 94065, if you wish to examine the list prior to the Annual Meeting. The stockholder list will also be available during the virtual Annual Meeting for examination by any stockholder.

Stockholder of Record: Shares Registered in Your Name

If, on the Record Date, your shares were registered directly in your name with the transfer agent for our common stock, Wells FargoEQ Shareowner Services, then you are a stockholder of record. As a stockholder of record, you may vote in person at the Annual Meeting or vote by proxy. Whether or not you plan to attend the Annual Meeting online, we urge you to fill out and return the Proxy Card or vote by proxy over the telephone or on the internet as instructed below to ensure your vote is counted.

Beneficial Owner: Shares Registered in the Name of a Broker, Bank or Other Agent

If, on the Record Date, your shares were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are the beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the Annual Meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the Annual Meeting.Meeting online. However, since you are not the stockholder of record, you may not vote your shares in person atduring the Annual Meeting unless you request and obtain a valid Proxy Card from your broker or other agent.

What am I being asked to vote on?

You are being asked to vote on three (3) proposals:

In addition, you are entitled to vote on any other matters that are properly brought before the Annual Meeting.

2

How do I attend, vote and ask questions at the Virtual Annual Meeting?

This year’s Annual Meeting will be held on May 23, 2024 at 10:30 a.m. Pacific Time. The Annual Meeting will be held entirely online to allow greater participation and improved communication and provide cost savings for our stockholders and the Company.

Log in Instructions. Stockholders of record as of March 28, 2024 will be able to attend and participate in the Annual Meeting online by accessing www.virtualshareholdermeeting.com/NVRO2024. To join the Annual Meeting, you will need to have your 16-digit control number which is included on your Notice of Internet Availability of Proxy Materials, your proxy card or on the instructions that accompanied the proxy materials.The audio webcast of the Annual Meeting will begin promptly at 10:30 a.m. Pacific Time. Online access to the audio webcast will open approximately fifteen minutes prior to the start of the Annual Meeting to allow time for you to log in and test the computer audio system. We encourage our stockholders to access the meeting prior to the start time.

Voting at the virtual Annual Meeting. Stockholders of record as of March 28, 2024 may vote their shares at www.proxyvote.com prior to or at www.virtualshareholdermeeting.com/NVRO2024 during the virtual Annual Meeting. Even if you plan to attend the Annual Meeting online, we recommend that you also vote by proxy as described herein so that your vote will be counted if you decide not to attend the Annual Meeting.

Submitting Questions prior to and at the virtual Annual Meeting. Stockholders may submit questions in writing during the Annual Meeting at the following website: www.virtualshareholdermeeting.com/NVRO2024. Stockholders will use their 16-digit control number which is included on their Notice of Internet Availability of Proxy Materials, their proxy card or on the instructions that accompanied the proxy materials. As part of the Annual Meeting, we will hold a live Q&A session, during which we will answer questions pertinent to the Company and the meeting matters as they come in and address those asked in advance, as time permits.

Technical Assistance. We will have technicians ready to assist stockholders beginning 15 minutes prior to the start of the virtual Annual Meeting and during the virtual Annual Meeting with any technical difficulties they may have accessing or hearing and viewing the virtual meeting.

If you encounter any difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting platform log-in page.

How do I vote?

Please note that by casting your vote by proxy you are authorizing the individuals listed on the Proxy Card to vote your shares in accordance with your instructions and in their discretion with respect to any other matter that properly comes before the Annual Meeting or any adjournments or postponements thereof.

The procedures for voting are as follows:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the Annual Meeting. Alternatively, you may vote by proxy by using the accompanying Proxy Card, over the internet or by telephone. Whether or not you plan to attend the Annual Meeting online, we urge you to vote by proxy to ensure your vote is counted. Even if you have submitted a proxy before the Annual Meeting, you may still attend the Annual Meeting and vote in person.online. In such case, your previously submitted proxy will be disregarded.

3

Beneficial Owner: Shares Registered in the Name of Broker, Bank or Other Agent

If you are a beneficial owner of shares registered in the name of your broker, bank or other agent, you should have received a voting instruction card and voting instructions with these proxy materials from that organization rather than from us. Simply complete and mail the voting instruction card to ensure that your vote is counted. To vote in person at the Annual Meeting, you must obtain a valid proxy fromwill need your broker, bank or other agent.16-digit control number. Follow the instructions from your broker, bank or other agent included with these proxy materials, or contact your broker, bank or other agent to request a proxy form.your 16-digit control number in the unlikely event that you do not have one.

We provide internet proxy voting to allow you to vote your shares online before the Annual Meeting takes place, with procedures designed to ensure the authenticity and correctness of your proxy vote instructions. However, please be aware that you must bear any costs associated with your internet access, such as usage charges from internet access providers and telephone companies.

Who counts the votes?

Broadridge Financial Solutions, Inc. (“Broadridge”) has been engaged as our independent agent to tabulate stockholder votes oras the Inspector of Election (the “Inspector”). If you are a stockholder of record, your executed Proxy Card is returned directly to Broadridge for tabulation. As noted above, if you hold your shares through a broker, your broker returns one Proxy Card to Broadridge on behalf of all its clients.

How are votes counted?

Votes will be counted by the Inspector appointed for the Annual Meeting. With respect to Proposal 3, the Inspector will separately count “1 Year,” “2 Years” and “3 Years” votes, abstentions and broker non-votes. For all other proposals, the Inspector will separately count “For” and, with respect to Proposal 2 and Proposal 3, “Against” votes, abstentions and broker non-votes. In addition, with respect to Proposal 1, the election of directors, the Inspector will count the number of “Withheld” votes received for the nominees. If your shares are held by your broker as your nominee (that is, in “street name”), you will need to obtain a proxy form from the institution that holds your shares and follow the instructions included on that form regarding how to instruct your broker to vote your shares. If you do not give instructions to your broker, your broker can vote your shares with respect to “routine” items, but not with respect to “non-routine” items. See below for more information regarding:“What “What are “broker non-votes?non-votes”?” and “Which ballot measures are considered “routine” or “non-routine”?”

What are “broker non-votes”?

Broker non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares. If the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank, custodian, nominee or other record holder of common stock indicates on a proxy that it does not have discretionary authority to vote certain shares on a particular proposal, then those shares will be treated as broker non-votes with respect to that proposal. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your vote is counted on each of the proposals.

Which ballot measures are considered “routine” or “non-routine?”

The ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 20162024 (Proposal 2) is considered “routine” under applicable rules. A broker or other nominee may generally vote on routine matters, and therefore no broker non-votes are expected to exist in connection with Proposal 2. The election of directors (Proposal 1) and the non-binding advisory vote on the frequencycompensation of future advisory votes onour named executive compensationofficers (Proposal 3) are

4

considered non-routine under applicable rules. A broker or other nominee cannot vote without instructions on non-routine matters, and therefore there may be broker non-votes on ProposalsProposal 1 and Proposal 3.

How many votes are needed to approve theeach proposal?

With respect to Proposal 1, the election of directors, the threeten nominees receiving the highest number of “For” votes will be elected.

In accordance with the policy adopted by our Board, in this election, an incumbent candidate for director who does not receive the affirmative “For” vote of a majority of the votes cast for his or her election (i.e., the director receives a greater number of votes “Withheld” for his or her election than votes “For”) shall promptly tender his or her resignation to the Board. The Nominating and Corporate Governance Committee of the Board, or a committee of independent directors in the event the subject director is a member of the Nominating and Corporate Governance Committee, will then make a recommendation to the Board and the Board (excluding the subject director) will make a determination as to whether to accept or reject the tendered offer of resignation generally within 90 days after certification of the election results of the stockholder vote. Following such determination, we will publicly disclose the decision regarding any tendered offer of resignation in a filing of a Current Report on Form 8-K with the SEC. If a director’s offer to resign is not accepted by the Board, such director shall continue to serve until his or her successor is duly elected and qualified, or until his or her earlier resignation or removal.

With respect to Proposal 2, the ratification of the selection, by the Audit Committee of our Board, of PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2024, the affirmative vote of the majority of votes cast (excluding abstentions) is required for approval. This is a routine proposal and therefore we do not expect any broker non-votes.

With respect to Proposal 3, the non-binding, advisory vote frequency alternative (1 Year, 2 Years or 3 Years) receivingto approve the highest numbercompensation of votes will be approved. If noneour named executive officers, the affirmative vote of the frequency alternatives receives a majority of the votes cast (excluding abstentions and broker non-votes), we is required for approval. While the vote on this resolution is advisory and not binding on us, our Compensation Committee and our Board will consider the highest numberoutcome of votes cast by the stockholders to be the frequency that has been selected by the stockholders. However,vote on this proposal is advisory and non-binding upon us.resolution when considering future executive compensation decisions.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you own as of the Record Date.

What if I return a Proxy Card but do not make specific choices?

If we receive a signed and dated Proxy Card and the Proxy Card does not specify how your shares are to be voted, your shares will be voted as follows:

If any other matter is properly presented at the Annual Meeting, your proxy (one of the individuals named on your Proxy Card) will vote your shares in his or her discretion.

Who is paying for this proxy solicitation?

We will pay for the entire cost of soliciting proxies. In addition to these mailed proxy materials, our directors, officers and employeesmay also solicit proxies in person, by telephone or by other means of communication. Directors, officers and employees

5

will not be paid any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

What does it mean if I receive more than one set of materials?

If you receive more than one set of materials, your shares are registered in more than one name or are registered in different accounts. In order to vote all the shares you own, you must either sign and return all of the Proxy Cards or follow the instructions for any alternative voting procedure on each of the Proxy Cards.

Can I change my vote after submitting my proxy?

Yes. You can revoke your proxy at any time before the final vote at the Annual Meeting. If you are the record holder of your shares, you may revoke your proxy in any one of three ways:

If your shares are held by your broker, bank or other agent, you should follow the instructions provided by them.

When are stockholder proposals due for next year’s Annual Meeting?annual meeting?

To be considered for inclusion in next year’s proxy materials, your proposal must be submitted in writing by December 7, 2016,14, 2024, to our Corporate Secretary at 1800 Bridge Parkway, Redwood City, California 94065; provided that if the date of the annual meeting is more than 30 days from May 18, 2017,23, 2025, the deadline is a reasonable time before we begin to print and send our proxy materials for next year’s annual meeting. Pursuant to the bylaws,Company’s Amended and Restated Bylaws (the “Bylaws”), in order for a stockholder to present a proposal for next year’s annual meeting, other than proposals to be included in the proxy statement as described above, or to nominate a director, you must do so between January 18, 201723, 2025 and February 17, 2017;22, 2025; provided that if the date of that annual meeting is more than

30 days before or more than 60 days after May 18, 2017,23, 2025, you must give notice not later than the 90th day prior to the annual meeting date or, if later, the 10th day following the day on which public disclosure of the annual meeting date is first made. You are also advised to review our bylaws,Bylaws, which contain additional requirements about advance notice of stockholder proposals and director nominations. In addition to satisfying the requirements under our Bylaws, to comply with the universal proxy rules under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), shareowners who intend to solicit proxies in support of director nominees other than the Company’s nominees must provide notice that sets forth the information required by Rule 14a-19 under the Exchange Act.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if the holders of a majority in voting power of the shares of common stock issued and outstanding and entitled to vote are present in personattendance online or represented by proxy at the Annual Meeting. On the Record Date, there were 28,298,82336,681,392 shares outstanding and entitled to vote. Accordingly, 14,149,41218,340,697 shares must be represented by stockholders presentin attendance online at the Annual Meeting or by proxy to have a quorum.

Your shares will be counted towards the quorum only if you submit a valid proxy or vote at the Annual Meeting. Abstentions will be counted towards the quorum requirement. If there is no quorum, either the chairperson of the Annual Meeting or a majority in voting power of the stockholders entitled to vote at the Annual Meeting, present in personattendance online or represented by proxy, may adjourn the Annual Meeting to another time or place.

6

How can I find out the results of the voting at the Annual Meeting?

Voting results will be announced by the filing of a Current Report on Form 8-K within four business days after the Annual Meeting. If final voting results are unavailable at that time, we will file an amended Current Report on Form 8-K within four business days of the day the final results are available.

Directions to Annual Meeting

Directions to our Annual Meeting, to be held at the Sofitel San Francisco Bay, 223 Twin Dolphin Drive, Redwood City, CA 94065 are available at: http://www.nevro.com

7

ELECTION OF DIRECTORS

Our Board, is divided into three classes. Each class consists, as nearly as possible, of one-third ofAt the total number of directors, and each class has a staggered, three-year term. Unless the Board determines that vacancies (including vacancies created by increases in the number of directors) shall be filled by the stockholders, and except as otherwise provided by law, vacancies on the Board may be filled only by the affirmative vote of a majority of the remaining directors. A director elected by the Board to fill a vacancy (including a vacancy created by an increase in the number of directors) shall serve for the remainder of the full term of the class of directors in which the vacancy occurred and until such director’s successor is elected and qualified.

The Board currently consists of seven seated directors, divided into the three following classes:

At each2019 annual meeting of stockholders, our stockholders approved an amendment to our amended and restated certificate of incorporation to declassify the successors toBoard over a period of three years. Accordingly, all directors whose terms will then expire willshall be elected to serve fromfor one-year terms expiring at the time of election and qualification until the third subsequentnext annual meeting after their election. Our Bylaws provide that the number of stockholders.directors constituting the Board shall be determined from time to time by the Board. Currently, the number of directors constituting the Board is fixed at eleven.

Drs. BehbahaniAccordingly, the terms for all of our directors, D. Keith Grossman, Michael DeMane, Frank Fischer, Kirt P. Karros, Sri Kosaraju, Shawn T McCormick, Kevin O’Boyle, Karen Prange, Susan Siegel, Kevin Thornal and Jaeger and Rami Elghandour,Elizabeth Weatherman expire at this Annual Meeting. Mr. Fischer has chosen to not stand for re-election at this Annual Meeting. Therefore, ten of our current President,directors have been nominated to serve as Class II directors and have each elected to stand for re-election (except for Mr. Elghandour, who is standing for election). In February 2016,by our Board approved an executive leadership succession plan pursuant to which, effective June 1, 2016, Mr. DeMane, our current ChairmanBoard. If elected, each of the Board and Chief Executive Officer, will transition to the role of Executive Chairman of the Board and Mr. Elghandour will assume the role of President and Chief Executive Officer. In connection with this executive leadership transition, our Board has nominated Mr. Elghandour for election to the Board. Each director to be electednominees will hold office fromfor one-year terms expiring at the date of their election by the stockholders until the third subsequent annual meeting of stockholdersfor fiscal year 2025 or until his or her successor is elected and has been qualified, or until such director’s earlier death, resignation or removal. After the Annual Meeting, the number of directors constituting the Board shall be fixed at ten.

Shares represented by executed proxies will be voted, if authority to do so is not withheld, for the election of the threeten nominees named below.above. In the event that any nominee should be unavailable for election as a result of an unexpected occurrence, such shares will be voted for the election of such substitute nominee as the Board may propose. Each person nominated for election has agreed to serve if elected, and management has no reason to believe that any nominee will be unable to serve. Directors are elected by a plurality of the votes cast at the meeting.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEIn accordance with the policy adopted by the Board, in this election, an incumbent candidate for director who does not receive the affirmative “For” vote of a majority of the votes cast for his or her election (i.e., the director receives a greater number of votes “Withheld” for his or her election than votes “For”) shall promptly tender his or her resignation to the Board. The Nominating and Corporate Governance Committee of the Board, or a committee of independent directors in the event the subject director is a member of the Nominating and Corporate Governance Committee, will then make a recommendation to the Board and the Board (excluding the subject director) will make a determination as to whether to accept or reject the tendered offer of resignation generally within 90 days after certification of the election results of the stockholder vote. Following such determination, we will publicly disclose the decision regarding any tendered offer of resignation in a filing of a Current Report on Form 8-K with the SEC. If a director’s offer to resign is not accepted by the Board, such director shall continue to serve until his or her successor is duly elected and qualifies, or until his or her earlier resignation or removal.

FOR THE ELECTION OF EACH NAMED NOMINEE.

The following table sets forth for the Class IIdirector nominees (who are currently standing for re-election, except for Mr. Elghandour, who is standing for election) and for our other current directors who will continue in office after the Annual Meeting,election or re-election) information with respect to their ages and position/office held within the Company:Company as of March 31, 2024:

Name | Age | Position/Office Held With the Company | Director Since | |||

| Class I Directors whose terms expire at the 2018 Annual Meeting of Stockholders | ||||||

Brad Vale, Ph.D., D.V.M. (2) | 63 | Director | 2015 | |||

Michael DeMane | 59 | Chairman of the Board and Chief Executive Officer (effective June 1, 2016, Mr. DeMane will step down as Chief Executive Officer and become Executive Chairman of the Board) | 2011 | |||

Lisa D. Earnhardt (1)(3) | 46 | Director | 2015 | |||

| Class II Directors whose terms expire at the Annual Meeting | ||||||

Ali Behbahani, M.D. (2)(3) | 39 | Director | 2014 | |||

Wilfred E. Jaeger, M.D. (1)(2) | 60 | Director | 2012 | |||

Rami Elghandour | 37 | President (effective June 1, 2016, Mr. Elghandour will become President and Chief Executive Officer) | — | |||

| Class III Directors whose terms expire at the 2017 Annual Meeting of Stockholders | ||||||

Frank Fischer (3) | 74 | Director | 2012 | |||

Shawn T McCormick (1) | 51 | Director | 2014 | |||

Name |

| Age |

| Position/Office Held With the Company |

| Director Since |

Director nominees for this Annual Meeting |

|

| ||||

D. Keith Grossman |

| 63 |

| Non-Executive Chairman, Former President and Chief Executive Officer |

| 2019 |

Michael DeMane |

| 67 |

| Lead Director |

| 2011 |

Kevin Thornal |

| 50 |

| Director, President and Chief Executive Officer |

| 2023 |

Kirt P. Karros (1) |

| 54 |

| Director |

| 2024 |

Sri Kosaraju (2) |

| 46 |

| Director |

| 2021 |

Shawn T McCormick (1) |

| 59 |

| Director |

| 2014 |

Kevin O'Boyle (1) |

| 68 |

| Director |

| 2019 |

Karen Prange (1)(3) |

| 60 |

| Director |

| 2019 |

Susan Siegel (2) |

| 63 |

| Director |

| 2020 |

Elizabeth Weatherman (2)(3) |

| 64 |

| Director |

| 2019 |

(1) | Member of the Audit Committee. |

(2) | Member of the Compensation Committee. |

(3) | Member of the Nominating and Corporate Governance Committee. |

8

Set forth below is biographical information for the nominees and each person whose term of office as a director will continue after the Annual Meeting. The following includes certain information regarding our directors’ individual experience, qualifications, attributes and skills that led the Board to conclude that they should serve as directors.

Nominees for Election to a Three-Year Term Expiring at the 2019this Annual Meeting of Stockholders

Ali Behbahani, M.D.D. Keith Grossman joined us in March 2019 as our President and Chief Executive Officer and additionally has served on ouras Chairman of the Board since September 2014. Dr. Behbahani joined New Enterprise Associates, Inc.May 2019. In April 2023, Mr. Grossman retired as President and Chief Executive Officer and was appointed to be the Executive Chairman of the Board. In October 2023, Mr. Grossman transitioned to Non-Executive Chairman of the Board. Mr. Grossman has over 30 years of experience in the medical device field. Prior to joining us, Mr. Grossman served as the President, Chief Executive Officer and director of Thoratec Corporation (“Thoratec”), or NEA, in 2007leading up to its 2015 sale to St. Jude Medical. Prior to Thoratec, he served as President, Chief Executive Officer and isdirector of Conceptus, a Partner on thewomen’s health medical device company, leading up to its sale to Bayer Healthcare. Prior to Conceptus, Mr. Grossman served as managing director of Texas Pacific Group (“TPG”), a private equity firm, as a member of its healthcare investment team. Prior to joining NEA, Dr. Behbahani workedTPG, Mr. Grossman served as Thoratec’s President, Chief Executive Officer and director for the first ten years of its growth as a consultant in business development at The Medicines Company,commercial company. Mr. Grossman currently serves as Lead Independent Director and a specialty pharmaceutical company developing acute care cardiovascular products. Dr. Behbahanimember of the nominating and corporate governance committee and the compensation committee of Outset Medical, Inc. Mr. Grossman also serves as Vice Chairman, chairperson of the governance and nomination committee and member of the innovation committee of Alcon, Inc., and previously held positionsserved as a venture associate at Morgan Stanley Venture Partners and as a healthcare investment banking analyst at Lehman Brothers. He conducted basic science research in the fieldsmember of viral fusion inhibition and structural proteomics at the National Institutes of Health and at Duke University. Dr. Behbahani currently serves on the board of directors of several privateViewRay, Inc., Intuitive Surgical, Inc., Kyphon, Inc., Zeltiq and a number of privately-held medical device companies. Dr. Behbahani has also beenMr. Grossman received a director of Adaptimmune Therapeutics plc, a public biopharmaceutical company, since September 2014, and serves on the nominating and governance committee. Dr. Behbahani holds an M.D.B.S. in Animal Science from The Ohio State University of Pennsylvania School of Medicine,and an M.B.A. from The University of Pennsylvania Wharton School and a B.A. in Biomedical Engineering, Electrical Engineering and Chemistry from DukePepperdine University. We believe that Dr. BehbahaniMr. Grossman is qualified to serve on our Board due to his extensive industry experience in the life science industry and his investment experience.

Wilfred E. Jaeger, M.D. has served on our Board since January 2012. Dr. Jaeger cofounded Three Arch Partners in 1993 and has servedmedical device sector, extensive leadership experience as a Partner and Managing Member since that time. Prior to cofounding Three Arch Partners, Dr. Jaeger was a general partner at Schroder Ventures. Dr. Jaeger currently serves on the boardchief executive officer of directors of Concert Pharmaceuticals, Inc., a public clinical stage biopharmaceutical company, and Threshold Pharmaceuticals, Inc., a public pharmaceutical company, as well as numerous private companies. Dr. Jaeger received a B.S. in Biology from the University of British Columbia, an M.D. from the University of British Columbia School of Medicine and an M.B.A from the Stanford Graduate School of Business. We believe that Dr. Jaeger is qualified to serve on our Board due to his investment experience, strategic leadership track recordmedical device companies and service on other boards of directors of life sciences companies.directors.

Rami Elghandour joined us in October 2012, has served as our Chief Business Officer and currently serves as our President. Effective June 1, 2016, when Mr. DeMane transitions to the role of Executive Chairman of the Board and steps down as Chief Executive Officer, Mr. Elghandour will assume the role of President and Chief Executive Officer. From September 2008 to October 2012, Mr. Elghandour managed investments for Johnson & Johnson Development Corporation, or JJDC, where he led several investments and served on the board of directors of a number of private companies, including our Board. Additionally, he led strategic initiatives in the development and management of JJDC’s portfolio. From 2001 to 2006, Mr. Elghandour worked for Advanced Neuromodulation Systems, Inc. (acquired by St. Jude Medical, Inc.), a medical device company, where he led firmware design and development on several implantable neurostimulators. Mr. Elghandour received an M.B.A. from the Wharton School of the University of Pennsylvania and a B.S. in Electrical and Computer Engineering from Rutgers University School of Engineering. We believe that Mr. Elghandour is qualified to serve on our Board due to his investment and engineering experience, strategic track record, and his service as our President.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE

FOR THE ELECTION OF EACH OF THE ABOVE NAMED NOMINEES

Directors Continuing in Office Until the 2018 Annual Meeting of Stockholders

Brad Vale, Ph.D., D.V.M., has served on our Board since March 2015. Dr. Vale was Head of Johnson & Johnson Development Company, or JJDC, from January 2012 to March 2015. Dr. Vale joined JJDC in March 1992, and in April 2008, was appointed to the position of Vice President, Head of Venture Investments. From September 1989 to March 1992, Dr. Vale supported Johnson & Johnson’s medical device businesses at the Corporate Office of Science and Technology as an Executive Director. From 1982 to 1989, he was at Ethicon, Inc., a Johnson & Johnson subsidiary, working on preclinical studies, new business development, and a coronary artery bypass graft internal venture. Dr. Vale currently serves or has served on the board of directors of several private companies. Dr. Vale holds a Ph.D. from Iowa State University, a D.V.M. from Washington State University and a B.S. in Chemistry and Biology from Beloit College. We believe that Dr. Vale is qualified to serve on our Board due to his investment experience and strategic leadership in the life sciences industry.

Michael DeMane joined us in March 2011 and serveshas served as our Chief Executive Officer and as Executive Chairman. Effective January 1, 2017, Mr. DeMane transitioned to non-executive Chairman of the Board and Chief Executive Officer. Effective June 1, 2016,Board. In May 2019, Mr. DeMane will transition to the role of Executive Chairman of the Board and step down as Chief Executive Officer.became our Lead Director. Mr. DeMane has served on the board of directors of several private companies since 2009, as well as on the board of directors of eResearch Technology, Inc., a public company specializing in contract research clinical services, and customizable medical devices, from July 2008 to April 2012. From March 2009 to June 2010, Mr. DeMane served as a Senior Advisor to Thomas, McNerney & Partners, a healthcare venture firm. Mr. DeMane served as the Chief Operating Officer of Medtronic Inc. from August 2007 to April 2008. Prior to his COO role, Mr. DeMane served at Medtronic Inc. as Senior Vice President from May 2007 to August 2007, Senior Vice President and President: Europe, Canada, Latin America and Emerging Markets from August 2005 to May 2007, Senior Vice President and President: Spinal, ENT and Navigation from February 2002 to August 2005, and President, Spinal from January 2000 to February 2002. Prior to that, he was President at Interbody Technologies, a division of Medtronic Sofamor Danek, Inc., from June 1998 to December 1999. From April 1996 to June 1998, Mr. DeMane served at Smith & Nephew Pty. Ltd. as Managing Director, Australia and New Zealand, after a series of research and development and general management positions with Smith & Nephew Inc. Mr. DeMane earned a B.S. in Chemistry from St. Lawrence University and an M.S. in bioengineeringBioengineering from Clemson University. We believe that Mr. DeMane is qualified to serve on our Board due to his investment experience, strategic leadership track record, service on other boards of directors of companies in the healthcare industry and his previous service as our chief executive officer.Chief Executive Officer.

Lisa D. EarnhardtKirt P. Karros has served on our Board since June 2015. SheFebruary 2024. Since November 2015, Mr. Karros has served as Senior Vice President, Finance and Chief Executive OfficerTreasurer of Intersect ENTHewlett Packard Enterprise, and previously served as Senior Vice President, Finance and Treasurer as well as Head of Investor Relations of Hewlett Packard Company. Prior to joining Hewlett Packard Company, Mr. Karros was a Principal and Managing Director of Research at Relational Investors LLC and a member of its boardthe firm's investment committee. While at Relational Investors, he assisted in identifying, evaluating, monitoring, and engaging portfolio companies and led the research team that focused on the technology, media, telecommunications, and energy sectors. Mr. Karros currently serves as the Executive Chairman of directors since March 2008. Prior to joining Intersect ENT, Ms. Earnhardt served as President of Boston Scientific’s Cardiac Surgery division (formerly known as Guidant Corporation, or Guidant) from June 2006 to January 2008 until its sale to Getinge Group. From August 1996 to April 2006, Ms. Earnhardt worked at Guidant in a variety of salesH3C Technologies and marketing leadership positions. Ms. Earnhardtpreviously served on the board of directors of Kensey Nash,both PMC-Sierra, Inc. and Innerworkings, Inc., where he was a publicly traded companymember of the Compensation Committee for both companies. Previously, Mr. Karros was an investment banker at Relational Advisors LLC where he advised clients on mergers and acquisitions and capital markets' financings and was an accountant at Arthur Andersen LLP. He is a Certified Public Accountant (inactive) and holds the professional designation of Chartered Financial Analyst. Mr. Karros earned his B.A. in Business Administration and M.S. in Accounting from 2011 until it was acquired by Royal DSM NA in 2012, where she served on the board’s nominating and governance and audit committees. Ms. Earnhardt holds an M.B.A. from Northwestern’s Kellogg School of Management and a B.S. in Industrial Engineering from StanfordSan Diego State University. We believe that Ms. Earnhardt is qualified to serve on our board of directors due to her experience in the medical device industry.

Directors Continuing in Office Until the 2017 Annual Meeting of Stockholders

Frank Fischer has served on our Board since October 2012. Mr. Fischer joined NeuroPace, Inc., a privately held developer of treatment devices for neurological disorders, in 2000 and currently serves as its President and Chief Executive Officer. From May 1998 to September 1999, Mr. Fischer was President, Chief Executive Officer

and a director of Heartport,��Inc., a formerly publicly traded cardiac surgery company (later acquired by Johnson & Johnson in 2001). From 1987 to 1997, Mr. Fischer served as President and Chief Executive Officer of Ventritex, Inc., a publicly traded designer, developer, manufacturer and marketer of implantable defibrillators and related products for the treatment of ventricular tachycardia and ventricular fibrillation, which was acquired by St. Jude Medical in 1997. Mr. Fischer currently serves on the board of directors of several privately held companies. Mr. Fischer received a B.S. in Mechanical Engineering and an M.S. in Management from Rensselaer Polytechnic Institute. We believe that Mr. FischerKarros is qualified to serve on our Board due to his extensive investment and management experience.

Sri Kosaraju has served on our Board since August 2021. Since October 2020, Mr. Kosaraju has served as the Chief Executive Officer and President of Inscripta, Inc., a privately-held digital genome engineering company. From August 2019 to May 2020, Mr. Kosaraju was President of Penumbra, Inc., where he also served as Head of Strategy from May 2015 to August 2019 and as Chief

9

Financial Officer from May 2015 to December 2019. Prior to that, Mr. Kosaraju spent 16 years at J.P. Morgan, including as Head of Healthcare Equity Capital Markets and Co-Head of Technology Equity Capital Markets. In addition to serving on the Board of Directors for Inscripta, Mr. Kosaraju also currently serves on the board of directors and is the chairperson of the audit committee of 10x Genomics, Inc., a life science technology company building products to interrogate, understand and master biology to advance human health. Mr. Kosaraju earned his B.S. in Mechanical Engineering from the Massachusetts Institute of Technology (MIT). We believe that Mr. Kosaraju is qualified to serve on our Board due to his extensive operational and management experience in the life science industry.finance and the healthcare industries.

Shawn T McCormick has served on our Board since September 2014. From November 2020 to February 2022, Mr. McCormick served as the Chief Financial Officer of Aldevron, L.L.C., which was acquired by Danaher in August 2021. Mr. McCormick previously served as Chief Financial Officer of Tornier N.V., a public medical device company (“Tornier”), from September 2012 to October 2015 when Tornier merged with Wright Medical Group. From April 2011 to February 2012, Mr. McCormick was Chief Operating Officer of Lutonix, Inc., a medical device company acquired by C. R. Bard, Inc. in December 2011. From January 2009 to July 2010, Mr. McCormick served as Senior Vice President and Chief Financial Officer of ev3 Inc., a public endovascular device company acquired by Covidien plc in July 2010. From May 2008 to January 2009, Mr. McCormick served as Vice President, Corporate Development at Medtronic, Inc., a public medical device company, where he was responsible for leading Medtronic’s worldwide business development activities. From 2007 to 2008, Mr. McCormick served as Vice President, Corporate Technology and New Ventures of Medtronic. From 2002 to 2007, Mr. McCormick was Vice President, Finance for Medtronic’s Spinal, Biologics and Navigation business. Prior to that, Mr. McCormick held various other positions with Medtronic, including Corporate Development Director, Principal Corporate Development Associate, Manager, Financial Analysis, Senior Financial Analyst and Senior Auditor. Prior to joining Medtronic, he spent four years with the public accounting firm KPMG Peat Marwick. He has beenwas a director of Entellus Medical, Inc., a public medical device company, since November 2014, and servesserved as the chairman of the audit committee and as a member of the nominating and corporate governance committee.committee from November 2014 to February 2018 when Entellus was sold to Stryker. Mr. McCormick has beenwas previously a director of SurModics, Inc., a public medical device and in vitro diagnostic technologies company, sincefrom December 2015 to December 2020, and servesserved on the audit committee and corporate governance and nominating committee. Mr. McCormick currently serves on the board of directors and is the chairperson of the audit committee of Inspire Medical Systems, Inc., medical technology company focused on innovative, minimally invasive solutions for patients with obstructive sleep apnea. Mr. McCormick earned his M.B.A. from the University of Minnesota’s Carlson School of Management and his B.S. in Accounting from Arizona State University. He is a Certified Public Accountant (inactive license). and was previously a National Association of Corporate Directors (NACD) Fellow. We believe that Mr. McCormick is qualified to serve on our Board due to his financial expertise and extensive operational experience in the medical device industry.

Kevin O’Boyle has served on our Board since March 2019. Mr. O’Boyle has over 20 years of executive management experience in the medical device industry. Mr. O’Boyle previously served as the audit committee chairperson at Sientra, Inc. until June 2023. Additionally, Mr. O’Boyle served as the chairman of the board and audit committee chairperson at GenMark Diagnostics, Inc. until it was acquired in May 2021. Mr. O’Boyle also served as a director and audit committee chairperson of Wright Medical Group N.V. Mr. O’Boyle previously served as Senior Vice President and Chief Financial Officer of Advanced Biohealing Inc. a medical device company, from December 2010 until it was acquired in July 2011. Mr. O’Boyle served as CFO of NuVasive, Inc. from January 2003 until December 2009. Prior to that, Mr. O’Boyle served in various leadership positions during his six years with ChromaVision Medical Systems, Inc. Mr. O’Boyle received a B.S. in Accounting from the Rochester Institute of Technology and completed the Executive Management Program at the University of California Los Angeles, John E. Anderson Graduate Business School. We believe that Mr. O’Boyle is qualified to serve on our Board due to his financial expertise and extensive management experience in the medical device industry.

Karen Prange has served on our Board since December 2019. From May 2016 to April 2018, Ms. Prange was Executive Vice President and Chief Executive Officer for the Global Animal Health, Medical and Dental Surgical Group at Henry Schein and a member of its Executive Committee. Prior to that, Ms. Prange was Senior Vice President of Boston Scientific and President of its Urology and Pelvic Health business from June 2012 to May 2016. Prior to working at Boston Scientific, Ms. Prange also held several leadership positions in increasing levels of responsibility at Johnson and Johnson Company, most recently as General Manager of the Micrus Endovascular and Codman Neurovascular business. In addition to currently serving on the board of directors for each of the following companies, Ms. Prange also serves as the chairperson of the compensation and management development committee and a member of the audit committee for Embecta Corp. and as the chairperson on the compensation committee for Atricure, Inc. Ms. Prange additionally serves on the board of WS Audiology, and is an industry advisor for EQT, a global investment organization. Ms. Prange earned her B.S. in Business Administration with honors from the University of Florida and has completed executive education coursework at UCLA Anderson School of Business and Smith College. We believe that Ms. Prange is qualified to serve on our Board due to her extensive healthcare leadership expertise in the life sciences industry.

10

Susan Siegel has served on our Board since December 2020. Until 2019, Ms. Siegel served as Chief Innovation Officer at General Electric and Chief Executive Officer of GE Business Innovations, a position she held since November 2017. Ms. Siegel had previously served as the CEO of GE Ventures since 2012, which was then subsumed into her new role. Prior to joining GE, from May 2006 to May 2012, she was a General Partner at Mohr Davidow Ventures, where she led healthcare and life science investments. From April 1998 to April 2006, Ms. Siegel was at Affymetrix, Inc. where she served as President and as a member of the board of directors. Since February 2019, Ms. Siegel has served on the board of directors of Illumina, Inc., a leading developer, manufacturer, and marketer of life science tools and integrated systems for the analysis of genetic variation and function, and also currently serves as the chair of its compensation committee, having previously served on its audit committee. Since March 2017, Ms. Siegel has served on the board of directors of Align Technology, Inc., a global medical device company, and also currently serves on its nominating and governance committee and technology committee. Ms. Siegel holds a B.S. in Biology from the University of Puerto Rico and a M.S. in Biochemistry and Molecular Biology from Boston University Medical School.We believe that Ms. Siegel is qualified to serve on our Board due to her investment experience and her operational and strategic leadership in the healthcare and life sciences industry.

Kevin Thornal was appointed as our President and Chief Executive Officer in April 2023 and has served as a member of our Board since May 2023. Mr. Thornal has over 20 years of experience in the medical device field. Mr. Thornal previously served as the Group President of Global Diagnostic Solutions at Hologic, Inc. (“Hologic”) from April 2022 to April 2023. Mr. Thornal served in several leadership positions with increasing levels of responsibility at Hologic from 2014 to April 2023. Prior to Hologic, Mr. Thornal held several roles of increasing responsibility at Stryker from 2004 to 2014 in sales, marketing, and business development. Mr. Thornal holds a B.A. in History and minors in English and Secondary Education from Southern Methodist University. We believe that Mr. Thornal is qualified to serve on our Board due to his extensive industry and leadership experience in the medical device sector.

Elizabeth Weatherman has served on our Board since March 2019. Ms. Weatherman has served as special limited partner of Warburg Pincus LLC, a leading global private equity firm, since 2016. Ms. Weatherman joined Warburg Pincus in 1988, became a partner in 1996 and served as a member of the Executive Management Group from 2001 to January 2016. She led the firm’s Healthcare Group from 2008 to January 2015. In addition to currently serving on the board of directors for each of the following companies, Ms. Weatherman also serves as the chairperson of the talent and compensation committee of Insulet Corporation; a member of the audit committee of Vapotherm, Inc.; and the chairperson of the nominating and corporate governance committee for Silk Road Medical, Inc. She also previously served as a director of Wright Medical Group N.V. She received a B.A. in English from Mount Holyoke College and an M.B.A. from Stanford Graduate School of Business. We believe that Ms. Weatherman is qualified to serve on our Board due to her service as a director on public company boards, including medical device companies, investment experience and healthcare industry knowledge.

THE BOARD RECOMMENDS A VOTE FORTHE ELECTION OF EACH OF

THE ABOVE-NAMED DIRECTOR NOMINEES

11

PROPOSAL NO. 2

RATIFICATION OF SELECTION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of our Board has engaged PricewaterhouseCoopers LLP as our independent registered public accounting firm for the year ending December 31, 2016,2024, and is seeking ratification of such selection by our stockholders at the Annual Meeting. PricewaterhouseCoopers LLP has audited our financial statements since the year ended December 31, 2006. Representatives of PricewaterhouseCoopers LLP are expected to be presentin attendance online at the Annual Meeting. They will have an opportunity to make a statement if they so desire and will be available to respond to appropriate questions.

Neither our bylawsBylaws nor other governing documents or law require stockholder ratification of the selection of PricewaterhouseCoopers LLP as our independent registered public accounting firm. However, the Audit Committee is submitting the selection of PricewaterhouseCoopers LLP to our stockholders for ratification as a matter of good corporate practice. If our stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain PricewaterhouseCoopers LLP. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent registered public accounting firm at any time during the year if they determine that such a change would be in the best interests of the Company and our stockholders.

Principal Accountant Fees and Services

The following table provides information regarding the fees incurred to PricewaterhouseCoopers LLP during the years ended December 31, 20152023 and 2014.2022. The Audit Committee approved all of the fees described below incurred since our initial public offering in November 2014.

| Years Ended December 31, |

| Years Ended |

| |||||||||||||

| 2015 | 2014 |

| December 31, |

| ||||||||||||

Audit Fees(1) | $ | 1,552,358 | $ | 1,864,965 | ||||||||||||

|

| 2023 |

|

| 2022 |

| ||||||||||

Audit Fees (1) |

| $ | 2,346,000 |

|

| $ | 2,000,000 |

| ||||||||

Tax Fees | — | — |

|

| 84,000 |

|

|

| — |

| ||||||

Audit-Related Fees | — | — |

|

| — |

|

|

| — |

| ||||||

All Other Fees | — | — |

|

| 2,000 |

|

|

| 6,300 |

| ||||||

|

| |||||||||||||||

Total Fees | $ | 1,552,358 | $ | 1,864,965 |

| $ | 2,432,000 |

|

| $ | 2,006,300 |

| ||||

|

| |||||||||||||||

(1) Audit fees of PricewaterhouseCoopers LLP for 2023 and 2022 were for professional services rendered for the audits of our financial statements, including accounting consultation and reviews of quarterly financial statements.

(2) Tax fees of PricewaterhouseCoopers LLP for 2023 were for tax advisory services.

(3) Other fees of PricewaterhouseCoopers LLP for 2023 and 2022 include support services not included in the service categories above.

Pre-Approval Policies and Procedures

The Audit Committee or a delegate of the Audit Committee pre-approves, or provides pursuant to pre-approvals policies and procedures for the pre-approval of, all audit and non-audit services provided by its independent registered public accounting firm. This policy is set forth in the charter of the Audit Committee and is available in the “Corporate Governance” section of our website at http://www.nevro.com/.

The Audit Committee approved all of the audit, audit-related, tax and other services provided by PricewaterhouseCoopers LLP since our initial public offering in November 2014 and the estimated costs of those services. Actual amounts billed, to the extent in excess of the estimated amounts, are periodically reviewed and approved by the Audit Committee.

THE BOARD OF DIRECTORS RECOMMENDS A VOTEFORRATIFICATION

OF OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

12

REPORT OF THE AUDIT COMMITTEE OF THE BOARD OF DIRECTORS

The material in this report is not “soliciting material,” is not deemed “filed” with the SEC and is not to be incorporated by reference into any filing of Nevro under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

The primary purpose of the Audit Committee is to oversee our financial reporting processes on behalf of our Board. The Audit Committee’s functions are more fully described in its charter, which is available onin the “Corporate Governance” section of our website at http://www.nevro.com/. Management has the primary responsibility for our financial statements and reporting processes, including our systems of internal controls. In fulfilling its oversight responsibilities, the Audit Committee reviewed and discussed with management Nevro’s audited financial statements as of and for the year ended December 31, 2015.2023.

The Audit Committee has discussed with PricewaterhouseCoopers LLP, the Company’s independent registered public accounting firm, the matters required to be discussed by Statement on Auditing StandardsStandard No. 61, as amended,1301, “Communications with Audit Committees,” as adoptedCommittees” issued by the Public Company Accounting Oversight Board (the “PCAOB”). In addition, the Audit Committee discussed with PricewaterhouseCoopers LLP their independence, and received from PricewaterhouseCoopers LLP the written disclosures and the letter required by Ethics and Independence Rule 3526 of the PCAOB. Finally, the Audit Committee discussed with PricewaterhouseCoopers LLP, with and without management present, the scope and results of PricewaterhouseCoopers LLP’s audit of such financial statements.

Based on these reviews and discussions, the Audit Committee has recommended to our Board that such audited financial statements be included in our Annual Report on Form 10-K for the year ended December 31, 20152023 for filing with the SEC. The Audit Committee also has engaged PricewaterhouseCoopers LLP as our independent registered public accounting firm for the fiscal year ending December 31, 20162024 and is seeking ratification of such selection by the stockholders.

Audit Committee | ||

Kevin O’Boyle, Chairperson | ||

Kirt P. Karros | ||

Shawn T McCormick | ||

Karen Prange |

13

Shawn T McCormick, ChairmanPROPOSAL 3

Lisa D. Earnhardt

Wilfred E. Jaeger, M.D.

NON-BINDING, ADVISORY VOTE ON THE FREQUENCY OF FUTURE ADVISORY (“SAY-ON-PAY”) VOTES BY STOCKHOLDERS ONTO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS

Summary

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) enables our stockholders to indicate how frequently they believe we should seek avote to approve, on an advisory, non-binding advisory vote from stockholders onbasis, the compensation of our named executive officers (our Chief Executive Officer, our Chief Financial Officer and our other three most highly compensated executive officers, collectivelyas disclosed in this Proxy Statement in accordance with the “NEOs”) i.e., how frequently to request futureSEC’s rules, commonly known as a “Say-on-Pay” votes from stockholders. Wevote. Accordingly, we are accordingly seeking a non-binding, advisory vote from stockholders as to the frequency with which our stockholders should have an opportunity to provide an advisory approval - a “Say-on-Pay” - of our NEO compensation. We are providing our stockholders with the choice of selecting a frequency of 1 year, 2 years or 3 years or abstaining from this advisory vote.

Pursuant to the Jumpstart Our Business Startups Act of 2012, also referred to as the JOBS Act, we are not required to seek an advisory “Say-on-Pay” vote until the end of the three-year period beginning on the date of first sale of our common stock pursuant to an effective registration statement under the Securities Act of 1933, as amended, which occurred in November 2014 in connection with our IPO. In compliance with this phase-in period, we intend to seek an advisory “Say-on-Pay” vote beginning with the annual meeting of stockholders to be held in 2017.

While we will continue to monitor developments in this area, the Board currently plans to seek an advisory “Say-on-Pay” vote from stockholders every year, beginning with the annual meeting of stockholders to be held in 2017. We believe that this frequency is appropriate because it will enable our stockholders to vote, on an advisory basis, on the most recent executive compensation information that is presented in each of our proxy statements, leading to a more meaningful and coherent communication between the Company and our stockholders onapprove the compensation of our NEOs.named executive officers as described in the “Compensation Discussion and Analysis” section of this proxy statement and the compensation tables and accompanying narrative disclosures that follow.

The Board’s current plan is further based on the premise that this recommendation could be modified if it becomes apparent that an annual frequency vote is not meaningful, is burdensome or is more frequent than indicated by best corporate governance practices.

Board Recommendation

Based on these factors,Our Compensation Committee and the Board believe that the information provided in the “Compensation Discussion and Analysis” section of this proxy statement, compensation tables and accompanying narrative disclosures demonstrates that our executive compensation program is designed appropriately, emphasizes pay for performance and aligns management’s interests with our stockholders’ interests to support long-term value creation.

Accordingly, our Board recommends that future advisory votes by stockholders on named executive officer compensation occur every year, until the next advisory vote on the frequency of future “Say-on-Pay” votes. Stockholders are not being asked to approve or disapprove the Board’s recommendation, but rather to indicate their choice among“FOR” the following frequency options: one year, two years or three years, or to abstain from voting on this item. If none of the frequency alternatives - one year, two years or three years - receives a majority of the votes cast, we will consider the highest number of votes cast by stockholders to be the frequency that has been selected by stockholders. Accordingly, we are asking stockholders to approve the following non-binding advisory resolution at the Annual Meeting:resolution:

RESOLVED, that the compensation of named executive officersstockholders of Nevro Corp. (the “Company”) be submitted toapprove, on an advisory vote bybasis, the compensation of the Company’s stockholders every (a) 1 year, (b) 2 years, or (c) 3 years, with such alternative that receivesnamed executive officers, as disclosed in “Compensation Discussion and Analysis,” compensation tables and the highest numberaccompanying narrative disclosures of votes cast representingthis Proxy Statement.

While the vote of stockholders.

The vote on this resolution is advisory and therefore not binding on us, the Company,Compensation Committee, or our Board, the Compensation Committee and our Board or its Compensation Committee. The Board may decide that it is invalues thoughtful input from stockholders and will consider the best interestsoutcome of the Company andvote on this resolution when considering future executive compensation decisions. Our Board has adopted a policy of providing for annual advisory votes from stockholders on executive compensation. Unless our Board modifies its stockholders to hold future advisory “Say-on-Pay” votes more or less frequently thanpolicy on the frequency indicated by stockholders in voting on this proposal.of future Say-on-Pay advisory votes, the next Say-on-Pay advisory vote will be held at the 2025 annual meeting of stockholders.

THE BOARD OF DIRECTORS RECOMMENDS THAT STOCKHOLDERS APPROVE, INVOTE, ON A NON-BINDING ADVISORY VOTE, THAT FUTURE ADVISORY VOTES BY STOCKHOLDERS ONBASIS, FOR THE RESOLUTION TO APPROVE THE COMPENSATION OF OUR NAMED EXECUTIVE OFFICERS BE REQUESTEDEVERY 1 YEAR.

14

CORPORATE GOVERNANCE

Code of Conduct and Ethics

We have adopted a Code of Conduct and Ethics that applies to all of our employees, officers and directors, including those officers responsible for financial reporting. The Code of Conduct and Ethics is available onin the “Corporate Governance” section of our website at http://www.nevro.com/. We expect that any amendments to the Code of Conduct and Ethics, or any waivers of its requirements, will be disclosed on our website. The reference to our web address does not constitute incorporation by reference of the information contained at or available through our website.

Corporate Governance Guidelines

We believe in sound corporate governance practices and have adopted formal Corporate Governance Guidelines to enhance our effectiveness. Our Board adopted these Corporate Governance Guidelines in order to ensure that it has the necessary practices in place to review and evaluate our business operations as needed and to make decisions that are independent of our management. The Corporate Governance Guidelines are also intended to align the interests of directors and management with those of our stockholders. The Corporate Governance Guidelines set forth the practices our Board follows with respect to Board and committee composition and selection, Board meetings, Chief Executive Officer performance evaluation and succession planning. A copy of our Corporate Governance Guidelines is available on our website at http://www.nevro.com/.

Director Resignation Policy if Majority Approval is Not Attained. In 2021, the Board amended our Corporate Governance Guidelines to provide that an incumbent candidate for director who does not receive the affirmative “For” vote of a majority of the votes cast for his or her election (i.e., the director receives a greater number of votes “Withheld” for his or her election than votes “For”) promptly tender his or her resignation to the Board. The Nominating and Corporate Governance Committee of the Board, or a committee of independent directors in the event the subject director is a member of the Nominating and Corporate Governance Committee, will then make a recommendation to the Board and the Board (excluding the subject director) will make a determination as to whether to accept or reject the tendered offer of resignation generally within 90 days after certification of the election results of the stockholder vote. Following such determination, we will publicly disclose the decision regarding any tendered offer of resignation in a filing of a Current Report on Form 8-K with the SEC. If a director’s offer to resign is not accepted by the Board, such director shall continue to serve until his or her successor is duly elected and qualifies, or until his or her earlier resignation or removal.

Independence of the Board of Directors

Under New York Stock Exchange rules and regulations, a majority of the members of a listed company’s board of directors must qualify as “independent,” as affirmatively determined by such board. The Board consults with the Company’s counsel to ensure that the Board’s determinations are consistent with all relevant securities and other laws and regulations regarding the definition of “independent,” including those set forth in pertinent New York Stock Exchange listing standards, as in effect from time to time.

Consistent with these considerations, our Board has determined that all of our current directors, other than Mr. DeMane and, if elected, Mr. Elghandour,Grossman, qualify as “independent” directors in accordance with the New York Stock Exchange listing requirements. Mr. DeManeGrossman is not considered independent because he is an employee of Nevro. Mr. Elghandour would not be considered independent because he is an employee of Nevro.our current President and Chief Executive Officer. The New York Stock ExchangeExchange’s independence definition includes a series of objective tests, such as that the director is not, and has not been for at least three years, one of our employees and that neither the director nor any of his family members has engaged in various types of business dealings with us. In addition, as required by New York Stock Exchange rules, our Board has made a subjective determination as to each independent director that no relationships exist, which, in the opinion of our Board, would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. In making these determinations, our Board reviewed and discussed information provided by the directors and us with regard to each director’s business and personal activities and relationships as they may relate to us and our management. There are no family relationships among any of our directors or executive officers.

As required under New York Stock Exchange rules and regulations, our independent directors meet in regularly scheduled executive sessions at which only independent directors are present. All of the committees of our Board are comprised entirely of directors determined by the Board to be independent within the meaning of New York Stock Exchange rules and regulations.

15

Leadership Structure of the Board

Our bylawsBylaws and Corporate Governance Guidelines provide our Board with flexibility to combine or separate the positions of Chairman of the Board and Chief Executive Officer and/or the implementation of a lead director

in accordance with its determination that utilizing one or the other structure would be in the best interests of the Company. Currently, Mr. DeMane servesGrossman joined us in March 2019 as theour President and Chief Executive Officer and has served as Chairman of the Board since May 2019. In April 2023, Mr. Grossman retired as our President and Chief Executive Officer and became the Executive Chairman of the Board. Effective June 1, 2016,In October 2023, he transitioned to Non-Executive Chair of the Board. Mr. DeMane has served as our Lead Director since May 2019.

During 2023, the non-management members of the Board met regularly in executive session. Mr. DeMane served as the presiding director during these executive sessions in which Mr. Grossman and Mr. Thornal did not participate, and Mr. DeMane, as Lead Director, served as a liaison to management on behalf of the non-management members of the Board.

Independent leadership remains an important pillar of our Board leadership structure and, as such, we anticipate that Mr. DeMane will transitioncontinue to serve as the role of Executive Chairman of the Board and step down as Chief Executive Officer. At that time, Rami Elghandour, our current President, will assume the role of President and Chief Executive Officer.

Mr. Fischer serves as presiding independentnon-management director at meetings of the independentnon-management members of the Board when they meet in executive sessions. In his role as presiding independent director, Mr. Fischer presides over the executive sessions of the Board in which Mr. DeMane does not participate and serves as a liaison to the Chief Executive Officer and management on behalf of the independent members of the Board.

session. The Board believes this leadership structure strikes an appropriate balance between effective and efficient Company leadership and oversight by non-management directors. We believe that Mr. DeMane’s experience as our Chief Executive Officer and Chairman of the Board will help maintain effective communication and coordination between the Board and Mr. Elghandour, our Chief Executive Officer and President as of June 1, 2016.

Our Board has concluded that our current leadership structure is appropriate at this time. However, our Board will continue to periodically review our leadership structure and may make changes as it deems appropriate.

Role of Board in Risk Oversight Process

Risk assessment and oversight are an integral part of our governance and management processes. Our Board encourages management to promote a culture that incorporates risk management into our corporate strategy and day-to-day business operations. Management discusses strategic and operational risks at regular management meetings and conducts specific strategic planning and review sessions during the year that include focused discussions and analyses of the risks facing us. Throughout the year, senior management reviews these risks with the Board at regular Board meetings as part of management presentations that focus on particular business functions, operations or strategies, and presents the steps taken by management to mitigate or eliminate such risks.